Search Results

31 results found with an empty search

- Fraud Friday

When your bookkeeper has all the control… your bank account becomes their playground. For this week’s Fraud Friday, I’m resurfacing one of the most important cases I’ve covered, as too many small businesses still make the same mistake: One person handled the books. The deposits. The bank statements. The vendor payments. And over time… tens of thousands quietly disappeared. Here’s the real warning: Fraud doesn’t start with a mastermind. It starts with access + trust + zero oversight. If you’re a small business owner, especially if you’ve “always done it this way” - this 2-minute video is worth your time. 👉 Watch the Fraud Friday case here: 👉 Then ask yourself: Who has too much control in your business? If something feels off, or if you want a quick sanity check on your internal controls, I’m always happy to talk. #FraudFriday #SmallBusiness #OccupationalFraud #InternalControls #Embezzlement #BookkeeperFraud #FraudPrevention #BlevinsAssociatesConsulting #CFE #RiskManagement

- Palm Springs Recognizes International Fraud Awareness Week. Why It Matters for Every City and Business

Last week, I had the honor of standing alongside Palm Springs Mayor Ron DeHarte as he presented an official Proclamation declaring November 16–22, 2025 as International Fraud Awareness Week in the City of Palm Springs. The proclamation was issued publicly during the DBA Learns workshop: Outsmarting the Scammers , a session led jointly by Matt Howe and me as part of the Desert Business Association’s education program. It was a powerful moment, not just for us as presenters, but for the entire community. Palm Springs made a clear and public statement: Fraud prevention matters. Our community cares. And our city is paying attention! Why This Proclamation Matters International Fraud Awareness Week is an annual global initiative focused on reducing the impact of fraud through education, prevention, and stronger internal controls. When a city publicly recognizes Fraud Week, it signals a commitment to: Strengthening public trust Protecting taxpayer dollars Increasing awareness of scams and occupational fraud Encouraging local businesses to adopt stronger safeguards Fraud is not an abstract concept. It hits cities, taxpayers, homeowners, and small businesses every single year. Palm Springs stepping up and acknowledging this risk is both responsible and forward-thinking. Fraud Against City Governments: A Growing Problem Nationwide Government entities, especially municipalities, are consistent targets for fraud. The Association of Certified Fraud Examiners (ACFE) reports that: Government and public administration organizations suffer a median loss of $150,000 per fraud case Occupational fraud lasts an average of 12–18 months before detection Lack of internal controls is the #1 contributing factor Cities are common targets for: Billing and vendor fraud Payment-approval manipulation Payroll schemes Purchasing card (P-Card) abuse Falsified expense reimbursements Misappropriation of restricted funds Cities that have suffered fraud losses in recent years range from small towns to major metropolitan areas, and the fallout is always the same: axpayer money is lost, public trust is eroded, and recovery is slow and expensive. This is why proclamations like the one issued by Palm Springs are more than symbolic. They reinforce a commitment to protecting public resources and making fraud prevention a visible civic priority. The Role of Local Business & Community Education Our DBA Learns session — Outsmarting the Scammers — addressed two critical angles of fraud: 1. Consumer and Cyber Scams Matt Howe provided actionable steps individuals and families can use to avoid increasingly sophisticated scams targeting residents. 2. Occupational Fraud Inside Small Businesses I walked attendees through real examples of internal fraud, common red flags, and practical steps business owners can take immediately to reduce risk. The proclamation made during our event underscored something the business community already knows: Fraud doesn’t just happen “somewhere else.” It happens in every city, every industry, and every size organization. And awareness is the first line of defense. More Live Workshops Coming — Stay Tuned The Palm Springs proclamation was an important milestone, but the work doesn’t stop there. We are continuing the momentum with additional live workshops in December and January , focusing on: Scam prevention for consumers Fraud risk management for small businesses Practical internal controls Steps leaders can take to reduce the risk of employee theft Why transparency and proper oversight protect everyone, including taxpayers Dates and registration details will be announced shortly. A Final Thought Fraud is a community issue, not just a business issue. When a city takes fraud prevention seriously, it strengthens local institutions, supports the business community, and protects the people who call it home. I’m grateful to the City of Palm Springs, the DBA, Matt Howe, and everyone who joined us this week to make International Fraud Awareness Week more than a slogan, but a catalyst for real action. Stay tuned for our upcoming workshops, and let’s continue building a safer, more fraud-resistant community together.

- When Your Vendor Becomes Your Thief: How Small Businesses Get Burned by Vendor Fraud

You trust your vendors. They deliver materials, provide services, and send invoices. In theory, you pay them in a timely manner and all is well. But what if one of those invoices is fake? Or the vendor is colluding with one of your employees to overbill you month after month? That’s vendor fraud. It's one of the most common, costly, and least-detected types of business fraud. The losses aren’t always obvious, but over time they drain profits, distort financials, and quietly erode your trust. The Ugly Truth About Vendor Fraud Small businesses are especially vulnerable because they often lack strict internal controls or segregation of duties. A single person may approve vendors, process invoices, and reconcile accounts, which makes it easy for manipulation to go unnoticed. As a Certified Fraud Examiner, I see the same patterns repeat themselves across different industries. The names change, but the schemes don’t. Here are some of the most common vendor fraud tactics: 1. Fake Vendors An employee sets up a bogus company, submits invoices for “services,” and pockets the payments. The fraud might continue for years, until someone finally questions why “ABC Consulting” has no real address or website. 2. Overbilling and Duplicate Invoicing A real vendor submits inflated or duplicate invoices, counting on your accounting team not to notice. Without proper cross-checks, you could easily pay twice, or pay for work never done. 3. Kickbacks This is where an internal employee and an outside vendor strike a deal. The vendor charges inflated prices, and the employee gets a “cut” under the table. It’s corruption, plain and simple, and it’s more common than most owners realize. 4. Product Substitution Vendors deliver cheaper or inferior goods than what was agreed upon, billing you for higher-quality items. Unless someone inspects the shipments closely, you’re paying for something you didn’t receive. 5. Bid Rigging and Collusion When multiple vendors coordinate to fix prices or manipulate bids, your “competitive” process becomes a sham. This often happens in construction, professional services, or procurement-heavy industries. How to Protect Your Business Vendor fraud isn’t random. It thrives where oversight is weak. Here’s how to fight back: 1. Vet Every Vendor Verify tax IDs, addresses, and ownership. Cross-check new vendor information with your employee list to make sure you’re not paying a company owned by one of your own people. 2. Separate Duties No one person should control vendor setup, invoice approval, and payment. Rotate responsibilities periodically to deter fraud and catch errors early. 3. Review Invoices Critically Watch for: Round-dollar invoices (no cents) Sequential invoice numbers Vague descriptions like “consulting services” or “miscellaneous work”. These are red flags worth digging into. 4. Audit Vendor Payments Regularly Run reports by vendor name, address, and bank account number. Duplicate matches are often the first clue of a problem. 5. Create a Speak-Up Culture Make it safe for employees to raise concerns without fear of retaliation. Many fraud cases are uncovered through tips, not audits. You may consider using a third party a whistleblower may feel more comfortable using. Don’t Wait Until It’s Too Late Vendor fraud doesn’t usually start big. It normally starts with a single fake invoice or a friendly “favor” that grows into something much worse. Once the pattern sets in, losses compound quickly. If something doesn’t feel right with your payables, trust your instincts and get a professional opinion before it becomes a six-figure problem. Need Help? At Blevins Associates Consulting , we specialize in helping small and mid-sized businesses uncover and prevent occupational fraud, including vendor and billing schemes. If you suspect a problem, or want to strengthen your internal controls, let’s talk. Schedule a confidential consultation at www.blevinsassociates.com or contact me directly to discuss your situation.

- When the Pastor Steals: Church Embezzlement and Board Oversight

Churches and nonprofits run on trust. That’s exactly why fraud can hide in plain sight. When one person controls donations, bookkeeping, and reconciliations, it isn’t “helpful”. It’s high risk. Here’s how embezzlement happens, what boards miss, and a simple oversight checklist you can put in place this week. A (very real) pattern we see One person handles donations + deposits + accounting Bank statements arrive to that same person No second set of eyes on reconciliations Board reports are summarized, not verified. Small gaps compound. Over months or years, “rounding errors,” “temporary loans,” and “cash-handling shortcuts” become six-figure losses that devastate ministries and community trust. Red flags (that look like “efficiency”) Consolidated control: same person records donations, makes deposits, and posts to the ledger Missing documentation: deposit slips without batch summaries; no donor roll-up to bank deposits Statement custody: bank statements routed to operations, not the treasurer/board Vague reports: totals without detail (no variance to budget, no prior-period trend) Resistance to oversight: “We’re too small for that,” “No time for double work,” “Donors wouldn’t understand” The fix: split key duties. Even in small organizations. You don’t need a big staff - you need two people touching the high-risk steps. Count & record donations: two people sign a batch sheet Deposit by Person A; ledger entry by Person B Bank statements go directly to the treasurer/board chair Monthly reconciliation prepared by staff; reviewed & signed by a board member Variance report to the board: actual vs budget, last month, last year Annual external look: review or audit, fraud risk analysis Board Oversight Checklist (printable) Statements delivered to a board member (not staff) Two-person donation count + signed batch sheet Deposit-to-donor reconciliation (batch roll-ups tie to bank) Monthly bank reconciliation with a board signature Variance reporting with explanations of >10% swings Policy on conflicts & personal reimbursements (with receipts) External review/Audit annually or fraud risk analysis; rotate reviewer every 2–3 years What to do this week Reroute statements to the treasurer (physical + e-delivery) Assign a board reviewer for reconciliations & variance reports Pilot the two-person count this weekend (simple batch sheet) Schedule a 20-minute call to scope an external review/fraud risk analysis. Download our Board Oversight Packet Here: Get our free Fraud Prevention Checklist Here . Want to discuss your situation? Give us a call, send an email, or book a time on our calendar here .

- Fraud Friday: Mail Theft Is on the Rise in Southern California

By Michael Blevins, CFE — Blevins Associates Consulting When Fraud Comes From the Outside We often talk about fraud as an “inside job,” but sometimes the threat comes from outside the business. In Southern California, a USPS worker was accused of stealing mail containing checks — part of a troubling increase in mail theft across the region. Stolen checks are rarely cashed as-is. Instead, they are often altered for higher amounts or used to gain access to bank accounts. This can devastate both individuals and small businesses. Why This Matters for Small Businesses If your business still mails paper checks, you’re at risk: Outgoing checks can be intercepted, stolen, and altered. Incoming payments may never reach your office or bank. Delayed reconciliations make it harder to spot missing payments quickly. In today’s environment, relying on the mail for critical payments exposes you to unnecessary fraud risk. Red Flags to Watch For Customers or vendors saying they mailed a check, but it never arrives. Duplicate or altered check numbers showing up on your bank statements. Unexplained payment delays or shortages in expected cash flow. What You Can Do Switch to secure electronic payments for vendors and customers. Monitor your accounts daily for unusual or missing items. Reconcile monthly to spot irregularities before they snowball. Use lockboxes or secure P.O. boxes if you must receive checks by mail. Watch Fraud Friday We break down the USPS worker case — and what it means for small businesses — in this week’s Fraud Friday video: 👉 Watch Fraud Friday: USPS Mail Theft Take Action Today Fraud is expensive, but prevention doesn’t have to be. ✅ Download the free Fraud Prevention Checklist to identify simple fixes you can make today. 📍 If you’re in Southern California, we can be on-site to review your fraud risks without the added expense of air travel. Note: All defendants are presumed innocent unless convicted or having entered a plea.

- Fraud in Dental Offices and Small Businesses — A Southern California Reality

By Michael Blevins, CFE — Blevins Associates Consulting Fraud Isn’t “Somewhere Else” - It’s Right Here in Southern California When most business owners think about fraud, they picture billion-dollar scandals splashed across national headlines. But the truth is, fraud happens right here in our own communities. In fact, recent cases across Southern California have shown just how vulnerable everyday businesses are — including dental practices, law firms, nonprofits, and even government offices . For a small or mid-sized business, one dishonest employee or one weak control can mean the difference between staying profitable and shutting the doors. Why Dental Offices Are at Risk Dental practices are particularly attractive targets for embezzlement and occupational fraud because of how their financial processes are structured: Patient payments are often collected at the front desk, with one staff member handling cash, checks, and credit cards. Refunds and adjustments are sometimes processed without adequate oversight. Inventory items (like implants or whitening products) can be misused or siphoned off. Billing and scheduling software can be manipulated if no one reviews exception reports. Without regular bank reconciliations and clear separation of duties , small amounts can be skimmed over months or years — adding up to six-figure losses. The Same Red Flags Apply to Other Small Businesses While dental offices are a clear example, the same red flags show up in law firms, medical practices, distributors, nonprofits, and professional service firms across Southern California: One person controls receipts, deposits, and reconciliations . No one reviews bank or trust accounts monthly. Vendor changes or invoices aren’t double-checked. Staff never take vacations or rotate duties . Fraud doesn’t discriminate by industry - it looks for opportunity. A Recent Example In one California dental office, an employee embezzled more than $200,000 over several years by taking small amounts from patient payments. Because there were no bank reconciliations and no separation of duties, the theft went undetected. We covered this story in our latest Fraud Friday video , which you can watch here: 👉 Fraud Friday: Dental Office Embezzlement What Business Owners Can Do Today Preventing fraud doesn’t require big budgets or complicated systems. The most effective safeguards are straightforward: Reconcile all accounts monthly, reviewed by someone independent. Separate duties so no single person controls an entire financial process. Require dual approval for refunds, voids, and vendor changes. Spot-check reports and encourage staff to take vacations. Ready to Get Ahead of Fraud? We’ve created a free tool to help you start: the Fraud Prevention Checklist . It takes just a few minutes to walk through but can highlight where your business might be vulnerable. 👉 Download the Fraud Prevention Checklist If you’re in Southern California and want a hands-on Fraud Risk Assessment or a CTAPP-readiness review for your law firm, reach out. We’re local, we understand the unique risks facing small businesses here, and we can be on-site without the added expense of air travel. #FraudFriday #FraudPrevention #DentalPractice #SoCal #SmallBusiness #InternalControls

- Occupational Fraud vs. Consumer Fraud: What’s the Difference and Why It Matters

Fraud is a word we hear often, but not all fraud is created equal. At Blevins Associates Consulting, we specialize in helping organizations prevent, detect, and respond to occupational fraud. But as a trainer for Operation Shamrock and advocate for fraud awareness, we also dedicate time to educating the public about consumer fraud, which affects individuals and families every day. What Is Occupational Fraud? Occupational fraud refers to fraud committed by employees against their employer. It’s the most costly form of fraud for businesses, especially small and mid-sized organizations. Common types include: Asset misappropriation (e.g., stealing cash, inventory, or equipment) Corruption (e.g., bribery, conflicts of interest) Financial statement fraud (e.g., manipulating books to hide losses) These schemes are often long-running, hidden, and devastating. As Certified Fraud Examiners (CFEs), we help companies uncover vulnerabilities through fraud risk assessments, internal control reviews, and employee training. Our goal is simple: stop fraud before it starts. What Is Consumer Fraud? Consumer fraud, on the other hand, targets individuals, not companies. It’s the kind of fraud that shows up in phishing emails, fake sweepstakes, or fraudulent calls pretending to be from the IRS. The most common consumer fraud schemes we see include: Phishing and identity theft Credit card and bank account fraud Medicare and health insurance scams Telemarketing and online shopping scams While anyone can be a victim, seniors are especially vulnerable. That’s why we offer community education events focused on empowering individuals, particularly older adults, to recognize and avoid these schemes and scams. A Dual Mission: Consulting and Community Education At Blevins Associates Consulting, we work with small and midsize businesses to mitigate the risk of occupational fraud. But we also believe fraud prevention is a community responsibility. That’s why we speak regularly on topics like: Consumer vs. Occupational Fraud – A clear breakdown of schemes and prevention strategies Fraud and the Senior Community – Tools to protect older adults from common scams What Is a Fraud Risk Assessment? And why every business should have one If your business, nonprofit, HOA, or senior group would like to host an educational session, we’d be glad to help. Below is list of topics we typically cover. Let’s Talk Whether you’re a business owner concerned about fraud inside your organization or a community leader looking to protect others from scams, Blevins Associates can support your mission. 📩 Contact us today at Michael@BlevinsAssociates.com 📞 Or call (760) 206-3717 🌐 www.BlevinsAssociates.com Together, we can fight fraud at every level. #OccupationalFraud #ConsumerFraud #FraudPrevention #FraudAwareness #InternalControls #SmallBusinessSecurity #ElderFraud #IdentityTheft #WhistleblowerProtection #CertifiedFraudExaminer #FraudRiskAssessment #OperationShamrock

- What To Do If You Suspect an Employee is Stealing From Your Business

Have you ever had that gut feeling something just isn't right within your own business? After working with dozens of business owners, my recommendation to you is to ACT! It could end up saving you thousands, or even tens of thousands of dollars in the long run. Many business owners don't know where to start or what to do. So, many will do nothing. And pay the price. Others will "act" like they are doing something, but in the end they don't. Some will just turn a blind eye, because they like the employee, are afraid to confront them, or are afraid they won't be able to find a replacement for them. I see this all the time. It's baffling - at least it is for me, because it doesn't seem as though that company is going to survive financially if they continue to nothing about their bottom line getting eaten away...from the inside! Why are they even in business? On the other hand, some business owners will make the decision to address the nagging feeling that something could be going on, and will contact a professional to assist them. I hope that's me , but in any case, they take action! Having an experienced outsider review the business operations, processes, controls and the like can be telling. Talking with the staff can be eye opening. Understanding the culture of the company is fascinating, and integral for this process. Helping our clients shape their future, craft their procedures, develop their fraud risk program, and assist them to protect their bottom line is what we strive to do. It's rewarding for the client, for me, and for my team. Think something is just "off" in your business? Feel free to reach out to us and let's have a conversation. No pressure, no b.s. #FraudPrevention #FraudInvestigations #SmallBusinessTips #SmallBusinessFraud #EmployeeTheft #EmployeesStealing

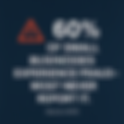

- Why We Often Don't Hear About Fraud in Small and Medium-Sized Businesses — Even Though It Happens All the Time

Fraud is a pervasive issue that affects businesses of all sizes. However, incidents involving small and medium-sized enterprises (SMEs) often go unreported or unnoticed. This lack of visibility can be attributed to several factors, including concerns over reputational damage, limited resources for detection, and the absence of robust internal controls. Why Fraud in SMEs Often Goes Unreported Reputational Damage : SMEs may fear that disclosing fraud could erode customer trust, deter investors, or provide competitors with an advantage. Resource Constraints : Unlike larger corporations, SMEs might lack dedicated compliance departments or the financial means to implement comprehensive fraud detection systems. Internal Relationships : In closely-knit organizations, fraudulent activities might be perpetrated by trusted employees, making detection and reporting more challenging due to personal relationships. Recent Examples of Fraud in California SMEs To illustrate the prevalence of fraud in SMEs, here are three notable cases from California within the past year: Bitwise Industries (Fresno, CA) : Co-founders Irma Olguin Jr. and Jake Soberal were sentenced to 9 and 11 years in federal prison, respectively, after pleading guilty to wire fraud and conspiracy charges. They admitted to defrauding investors of over $100 million by misrepresenting the company's financial health and operations. GameOn (San Francisco, CA) : Former CEO Alexander Beckman and his wife Valerie were indicted on multiple counts, including wire fraud and securities fraud. They allegedly deceived investors by fabricating revenue figures, bank statements, and customer relationships, raising over $60 million under false pretenses. Mark Roy Anderson (Beverly Hills, CA) : A disbarred attorney, Anderson was sentenced to 25 years in prison for orchestrating a CBD scam that defrauded investors of nearly $18.8 million. He falsely claimed to operate hemp farms and sell CBD-infused products, using the funds for personal luxuries instead. The Role of Fraud Examiners in Mitigating Risks Engaging a Certified Fraud Examiner (CFE) can be instrumental in preventing and detecting fraudulent activities within SMEs. CFEs bring specialized expertise to: Conduct Risk Assessments : Identify vulnerabilities in financial systems and operational processes. Implement Internal Controls : Establish checks and balances to deter fraudulent behavior. Train Staff : Educate employees on recognizing and reporting suspicious activities. Investigate Allegations : Carry out thorough investigations when fraud is suspected, ensuring evidence is collected appropriately for potential legal proceedings. Conclusion While fraud in SMEs may not always make headlines, its impact can be devastating. Proactive measures, including the engagement of fraud examination professionals, are essential in safeguarding businesses against such threats. Transparency, robust internal controls, and a culture of accountability can significantly reduce the risk of fraud and its associated consequences. If you're interested in learning more about how a Certified Fraud Examiner can assist your business, feel free to reach out to us at Blevins Associates Consulting. #FraudPrevention #OccupationalFraud #InternalControls #SMBsecurity #BusinessEthics #BlevinsAssociates

- Sorting Through the Chaos: A Fraud Examiner’s Challenge

As a Certified Fraud Examiner, I’ve encountered businesses of all types, but some cases stand out because of the sheer volume of issues at play. One such case involved a recent client whose organization was drowning in complexity, making it difficult to pinpoint the true fraud risks. After my initial meeting with the client - a fast-growing logistics firm - it became clear that there was a LOT going on. The owner, I’ll call him “Jim,” was juggling multiple responsibilities: overseeing operations, managing finances, and personally approving vendor payments. His company was expanding quickly, but internal controls had not kept pace, or simply didn’t exist. With a multitude of overlapping concerns, I had to sift through layers of information to focus on the actual fraudulent activity at play. I held numerous meetings, conducted interviews with staff and management, and looked through several years’ worth of company, financial and banking records. After some research, I was able to eliminate some of the issues from further investigation, as they were determined to be waste and abuse rather than outright fraud. We made note of these issues but decided to narrow the scope of this engagement and focus our time on those with larger potential exposure, and the availability of records. I asked Jim to provide a priority list, which he did. While I concentrated on his list, there was one aspect that just didn’t feel right to me. Even though it wasn’t high on Jim’s priority list, I asked if I could continue my research on these lesser-considered items, just to ensure a thorough review. I even offered to do this on my own time. Jim didn’t think it would yield anything significant - the proverbial “smoking gun” we’ve been looking for, but he provided me with the documentation needed to continue the review. And low and behold, that’s exactly where I found it. The client was both relieved and dismayed. I had uncovered significant fraud - his business partner had been skimming large amounts of cash. Beyond that, my team and I discovered additional issues which we detailed in the final report we ultimately provided our client. Now, it was up to Jim to decide what to do with the findings. For a business owner, this can be an excruciating position to be in. I’ll move on to the next client, but I fully expect to be called to testify in court as to my findings in approximately four months, in that there is already active litigation between my client and his partners. Par for the course in this line of work - once I file my report, litigation is typically expected next as part of the process. Sometimes, experience combined with a gut feeling can lead you to the truth. If business owners suspect internal fraud exists within their company, they need to act immediately before the losses add up. A Certified Fraud Examiner can help them navigate the process and protect their business. #SmallBusinessFraud #BlevinsAssociatesConsulting #HiddenFraud #ProtectYourBusiness

- Protecting Yourself from Wire Fraud in Real Estate Transactions

Real estate transactions are some of the largest financial commitments people make, and with the increase in online financial interactions, they have also become prime targets for wire fraud. Criminals employ sophisticated tactics to deceive buyers, sellers, and real estate professionals, redirecting substantial amounts of money to fraudulent accounts. In this article, we’ll explore what wire fraud in real estate looks like, how it happens, and, most importantly, how you can protect yourself. What is Wire Fraud in Real Estate? Wire fraud in real estate typically involves scammers intercepting communication between parties in a transaction, such as buyers, sellers, real estate agents, and closing attorneys, to manipulate wire instructions. By posing as a trusted party, these fraudsters trick buyers into sending funds directly to their own accounts. This is particularly dangerous in real estate, where wire transfers often involve large sums and tight timelines. How Does Wire Fraud Happen? Fraudsters often use a technique known as "business email compromise" (BEC) to carry out these scams. Here’s how it generally unfolds: Phishing and Email Hacking : Scammers gain unauthorized access to the email accounts of real estate agents, attorneys, or title companies, often through phishing emails that trick someone into sharing login information. Monitoring and Mimicking : Once inside, they monitor communications, learning the details of upcoming transactions, including names, financial information, and transaction timelines. Just before the closing, they send a seemingly legitimate email with fake wire instructions. Fake Emails : These fraudulent emails may look almost identical to real ones, complete with logos and language that mirrors the legitimate party. The emails typically contain urgent instructions, pressuring buyers to wire the money quickly to avoid delays. The Redirected Funds : If successful, the buyer unknowingly wires funds directly to the fraudster’s account, where the money is quickly transferred out and laundered, making recovery very difficult. Signs of Wire Fraud Attempts Recognizing the warning signs of wire fraud attempts can help protect you from falling victim to these scams: Last-Minute Changes : Beware of last-minute changes to wire instructions, especially if they come via email. Urgent Requests : Fraudsters often create a sense of urgency to encourage quick action without second-guessing. Suspicious Email Addresses : Carefully check the sender’s email address. Fraudulent emails may use addresses that look similar to a legitimate one, but with subtle differences (like missing or added letters). Poor Grammar and Spelling : Scammers may make mistakes in spelling or grammar, though some are very sophisticated and professional-looking. Steps to Protect Yourself from Wire Fraud Preventing wire fraud requires caution, skepticism, and proactive verification. Here are some effective ways to protect yourself during a real estate transaction: Verify All Wire Instructions by Phone : Always verify wire instructions by calling the trusted party, such as your agent, attorney, or title company, using a known and verified phone number. Never rely on phone numbers provided in an email, as these could be fake. Use Secure Email Practices : Avoid sharing sensitive financial information via email. If possible, use encrypted email services or secure online portals provided by your real estate team. Double-Check Any Changes : Treat any change in wire instructions as a potential red flag. If you receive an email with updated instructions, verify it immediately through a trusted contact. Be Cautious with Emails and Links : Don’t click on links or open attachments in unsolicited emails, and be cautious with emails that contain links or attachments, especially if they seem unexpected or suspicious. Keep Your Systems Secure : Regularly update your computer's software and use antivirus tools to prevent malware that could compromise your email or online security. Educate and Inform All Parties : Ensure everyone involved in the transaction (spouse, co-borrowers, real estate agent) understands the risks and remains vigilant. What to Do if You Suspect Fraud If you realize you may have been a victim of wire fraud, act quickly: Immediately Contact Your Bank : Alert your bank about the fraudulent transfer as soon as possible. They may be able to freeze the funds if caught in time. Report to Law Enforcement : File a report with the FBI’s Internet Crime Complaint Center (IC3) at www.ic3.gov . The FBI has teams dedicated to investigating wire fraud, but quick reporting is crucial. Notify All Transaction Parties : Inform your real estate agent, attorney, and title company. They may be able to assist and help secure any additional information about the fraud. Conclusion Wire fraud in real estate is a serious threat, but with awareness and proactive measures, you can significantly reduce the risk of falling victim to these scams. Remember to verify all wire instructions by phone, be cautious with email communications, and educate everyone involved in the transaction. By staying vigilant and informed, you can protect your hard-earned money and ensure a safer real estate experience. With the growing sophistication of scammers, understanding wire fraud and taking preventative actions are essential steps in protecting your assets during a real estate transaction.

- The Hidden Cost of Fraud

Alrighty, then. We decided to make a video... 💸 Small businesses lose around 5% of their revenue to fraud every year. The worst part? Most of it happens inside the business—where you least expect it. Employees… vendors… even people you trust. And it often starts small—fake invoices, overlooked expenses — until it costs you, the small businessowner, thousands. In this video, I share where those risks hide—and what you can do now to protect your business. 👉 How confident are you in your internal controls? Let me know—or message me if you’d like to chat through a quick fraud risk check for your business. #SmallBusiness #FraudPrevention #RiskManagement #BusinessGrowth #Entrepreneurship #FraudInvestigation